Benefits of merging the two villages in the Town of Pelham

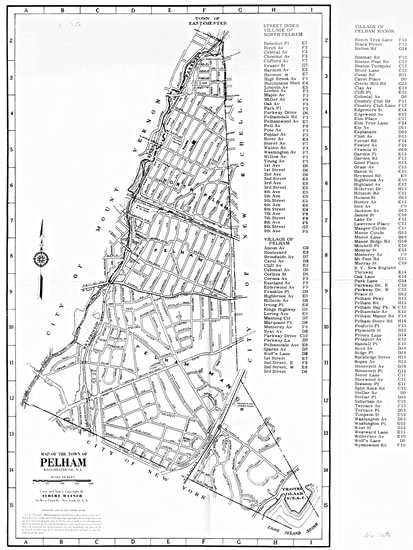

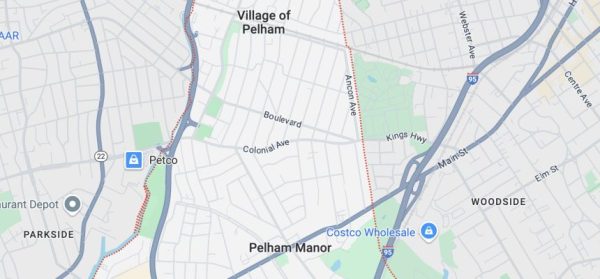

I first became puzzled by our local government as a new reporter. When searching for contact information to call the Pelham government for a story, I came across three different phone numbers. Those numbers were for the Town of Pelham, the Village of Pelham, and the Village of Pelham Manor.

I soon came across a chart on the town website titled “Pelham Governance.” This chart included the legislative bodies and responsibilities of all three local governing administrations. However, instead of mitigating my confusion, this chart inspired more questions. The duties of the villages made up longer lists than the town and included seemingly important functions of government like police and fire. Moreover, the two villages had virtually all the same responsibilities.

Immediately, I thought the system made little sense. Why wouldn’t the town just hold all responsibilities? Wouldn’t that make things simpler? Not to mention reducing the number of municipalities I had to contact by a whopping ⅔!

The villages within the Town of Pelham first emerged because of population disparities. In the 19th century, City Island was included in the Town of Pelham and was the largest population center. Throughout New York State, towns were being dominated by the votes of population centers within the town. Thus, areas of a lower population had less of a say in government.

To rectify this issue, New York State passed legislation that incentivized the creation of villages. The goal was to give small pockets of the population within a larger town more control over their tax money.

The idea of joining the villages in Pelham is an old one. According to Town Historian Blake Bell, the idea of combining the two villages was first seriously discussed in 1923. The aim of the proposed merger was to maintain local political power and to avoid annexation by the ever-expanding city of New York.

Meaningful discussion of a merger erupted again in 1975, this time to alleviate the financial burden of a recession caused by the 1973 Arab Oil Embargo, government spending from the Vietnam War, and a stock market crash in 1974. The proposed merger was between the Village of Pelham, occupying the area now known as Pelham Heights, and the Village of North Pelham, the area now called Pelhamville.

“Everyone was looking for ways to reduce taxes and cut down the economic impact on local people,” Bell said. “One way of doing that was to combine municipalities.”

The proposal went to a vote. Voters favored the merger by a significant margin (around 78 percent voted yes). The issue afterward became determining what the real impact of the merger was. Cost savings were liberally predicted to be in the range of $200,000 to $250,000 prior to the vote.

According to Bell, there has been no comprehensive analysis showing the true amount saved by the village governments. “This is pure speculation, but the only explanation is that once the merger was achieved, they weren’t willing to look back and fight the battle,” he said. “I’m not convinced one way or the other.”

Now, we are faced with a new period of financial burden. The Republican tax bill passed last year will cap deductions from state and local taxes starting with 2018’s returns. Because of Pelham’s significant property taxes (with a median of $27,000 annually), Pelhamites will feel this burden even more.

When discussing a merger, it is important to consider where there is money to be saved. Public safety is a huge portion of the budgets of both villages. According to a blog post by David Joachim, Financial Investigations Editor for Bloomberg News and Pelhamite, which analyzed the taxes of the Pelham governments, each village spends over 40 percent of its budget on police and fire, not including employee health or retirement benefits.

According to Joachim, the Village of Pelham and the Village of Pelham Manor both have a greater density of police and firemen than the vast majority of villages in New York State and the national average for municipalities with under 10,000 residents. For reference, Pelham has an annual crime rate of 0.85 violent crimes and 12.25 property crimes per 1000 residents compared to national rates (as of most recent data) of 3.757 violent crimes and 25.96 property crimes per 1000 residents. In other words, Pelham has above average size police force for below average rates of crime.

“Some of the figures I found police and fire definitely jump out me,” Joachim said. “I can’t escape the conclusion that there’s money to be saved somewhere there.”

It’s hard to pinpoint the exact amount that could be saved for Pelham and the individual taxpayer. Joachim uses the example of a 20 percent cut to the Pelham Manor Village budget, which would result in savings of $125 per month for the typical Pelham household, or $1,500 a year. Although this hypothetical amount does not make up for deductions lost which could end up totaling around $6,000 per year, it is not insignificant. As Mayor Michael Volpe of the Village of Pelham points out in Joachim’s blog post, even small savings can make a difference for struggling families. Simply put, any money saved for taxpayers is a good thing.

At the end of the day, merging the two villages would mean a more efficient government. Less confusion, fewer phone numbers to call, and more effective use of your tax dollars. The initial motivations for the creation of separate villages have long since become irrelevant. It is easy to argue that a merger would be inconvenient in the short term, however, there is no real need for two villages.

Ben Glickman is a freshman at Brown University. He started his journalism career writing for the school newspaper, the Pel Mel, as a columnist and editorial...

Charles Stern • Jan 3, 2019 at 8:43 pm

Thomas, if you are suggesting I’m a hypocrite, you are essentially correct, but I’m not a pretender. I hate our segregated school system, but I pay the tolls anyway. Westchester and Nassau have lots of “Pelhams” that lock in discrimination in education, housing and jobs. The article spells out a formula for lower taxes and less waste, but that’s not really the calculus, is it?

Thomas F Imperato • Dec 27, 2018 at 9:33 am

Charles Stern, apparently you agree as you moved your family from Mt. Vernon to Pelham, for the schools.

Charles Stern • Dec 25, 2018 at 1:12 pm

Invert it. The village boundaries ARE relevant. The police saturation drives high taxes, that keeps the schools white and affluent. Residents like it that way, and are willing to pay the premium to maintain it.

Patrick Donovan • Dec 23, 2018 at 10:36 am

“the area now called Pelhamville” Who started calling North Pelham Pelhamville? And why? Has there been some decision that the name should change? Apparently a de facto association adopted the name, and others thought it was somehow official. What the heck is wrong with “North Pelham”?

Michael Treanor • Dec 23, 2018 at 10:29 am

Congratulations. Well done. Call when you have a chance.

Darryl Adams • Dec 23, 2018 at 12:15 am

“Pelham has above average size police force for below average rates of crime.”

I think the above average police force is what causes the before average rates of crime. I’m all for saving money, but arguing that fewer police are needed because the ones we have do such a great job is not a good argument.

Paul Mottola • Dec 22, 2018 at 4:46 pm

I’d like to address a few points in this article. Most important is this: the reason for formation of the villages is accurately reported, but the writer inexplicably concludes that those reasons are now “irrelevant”. They are not irrelevant. There is a move in New York State to consolidate layers of government, which is exactly what was happening in the 1890s with the expansion of New York City. Keeping the village form of incorporation is essential to retaining local control of our government.

Next is regarding police and crime rates. It’s true that the Pelhams have a high number of sworn police officers per population. That we also have a much lower than average crime rate is surely — at least in part — *because* we have a large police force, and not evidence that we should have a smaller one.

Lastly, while David Joachim’s article is generally well researched and reported, it has a flaw that unfortunately has been repeated here. The median homeowner paying $27k in local taxes almost certainly was in the AMT tax bracket under the old law and thus was already unable to take the SALT deduction. I know because I am that guy. I will pay *less* total federal tax under the new law.

Thomas F Imperato • Dec 21, 2018 at 7:18 pm

Very well written piece Ben.