School board adopts $76.7 million budget, prepares for mail election with DeDominico, Childs unopposed for trustee

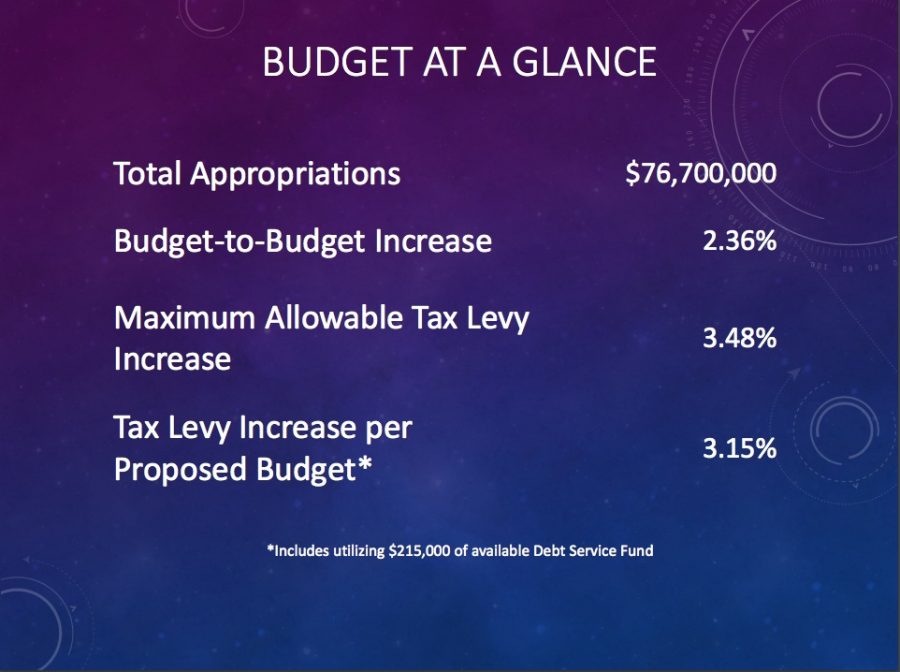

The Pelham Board of Education Tuesday unanimously voted to adopt a $76.7 million proposed budget for the 2020-2021 fiscal year, sending the spending plan to district residents, who will vote by mail.

The board reviewed plans for the budget vote and school trustee election. As ordered by Gov. Andrew Cuomo, the election will be solely by absentee ballots, which must be received by the district clerk by 5 p.m. on June 9.

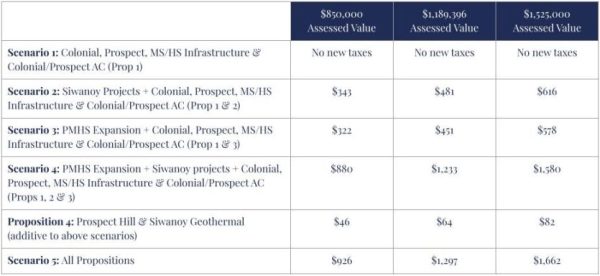

On the ballot will be the proposed spending plan, as well as a proposition to allocate unspent funds within the approved 2018 capital bond from athletic fields to building projects. The ballot will also include two school board seats. Board President Jessica DeDominico and Board Vice President Sue Childs are running unopposed for reelection to three-year terms. Their statement came on May 11—the deadline for filing petitions for the two open seats.

The Citizen’s Nominating Committee, which recruits, seeks and endorses as qualified candidates for school board service, apparently did not operate this year. Its call for candidates usually comes in March. This may be the first time the CNC has not met since its founding in 1954 (an update on the CNC will follow).

Regarding preparations for the election, Pelham Superintendent of Schools Dr. Cheryl Champ said ballots are expected to be mailed the day after Memorial Day and recommended that everyone read the instructions closely. District Clerk Millie Bonilla said the vendors the district has secured would help to quickly provide ballots for all 8,000-plus Pelham voters. The ballots will be mailed first class. Voters must sign the statement and fill out the envelope, otherwise the ballot may be invalidated, she said. The district has registered for a business-reply permit and notified the post office.

Champ began the budget discussion by going over the budget overview before Assistant Superintendent for Business James Hricay reviewed specifics and answered the board’s questions.

Champ said the budget reflected the district’s attempt to work within current limits and reallocating funding, pointing out that with “budget constraints, we can’t be adding, we can’t be looking to do more, we’ve got to do better with what we have.”

She said the proposed budget aligned with the district’s 2019-2024 strategic plan, maintained student programs and class sizes and “provides for academic and social-emotional needs of a student.”

When discussing reserves and the impact of Covid-19 on budgeting, she said the district recognizes that “right now things are tight, but this is probably not the worst of it.”

From the initial proposed 2020-2021 budget, which out came prior to most of the significant economic impacts of Covid-19, the school faced a $670,000 gap due to a reduction in state aid, according to Champ. The gap was closed by making personnel adjustments, purchasing ahead of time, eliminating unneeded rent, reducing teacher overages and lowering the contingency. On top of those changes, which Champ noted “do not touch any student programs,” the district is also looking to use $215,000 of its debt service reserve.

The budget represents a 2.36% increase from the 2019-2020 spending plan. The proposed homeowners tax levy increase is 3.15%, which is under the 3.48% maximum allowed by the state cap with exclusions, Champ said. The tax levy increase was decided after the district applied the standard growth factor and factored in the 1.81% gain in the Consumer Price Index for the operating budget, showing the operating portion of the levy could rise by 2.2%. The further .95% comes from the capital budget, which includes factors such as a drop in building aid, 2018 capital project funding, a reduction in debt service payments and the use of the debt service fund.

Year-to-year spending cuts came from the retirement of nine teachers and two administrators, who typically are replaced by persons lower on the pay scale. Additionally, savings were found in reduced out-of-district tuition costs attributed to shifting student needs and the removal of a property lease. According to Champ, spending increases were “very typical and expected.” These included the Teachers’ Retirement System and health care, debt service from the 2018 capital projects, student transportation and BOCES costs.

Hricay opened his discussion of the specifics by noting the budget was “a plan, and plans change, but this is the best plan that we have and that we’ve been talking about on how to execute what the district needs.”

The district’s revenue is expected to grow $1.77 million (2.36%), with property tax revenue expected to rise by just over $2 million. Property taxes make up over 85% of the budget, with state aid contributing about 9% and appropriated fund balance and miscellaneous receipts making up the remainder.

Hricay said the total property value of both Pelham homestead and non-homestead properties sits at more than $3.4 billion, according to the Town of Pelham assessor on May 6.

State aid is forecast to drop 7.8%, or $590,000, with roughly $85,000 of that loss being considered a pandemic adjustment, which the federal government will provide as part of the CARES Act, according to Hricay. Other receipts, including tuition, sales tax, health services and refunds of prior expenses, represent about $2.7 million of income and will see an increase of about 0.1%. Appropriations from reserves and debt service would be drawn from this year’s surplus of $650,000, Employee Retirement System reserves of $600,000 and debt service fund of approximately $345,000.

Speaking on the expenditure side of the budget, Hricay highlighted that as expected, salaries and benefits comprise roughly 80% of the budget. Broken into the three components mandated by New York State law, Hricay said instructional programming made up 77% of the budget, capital spending 15% and administrative expenses of 9%.

In response to a question from DeDominico, Hricay explained what would occur if the budget did not pass. “If you have the two failed budgets, the existing tax levy is your current-year tax levy,” said Hricay. “So, as we saw, the proposed levy’s increasing $2 million.”

That would mean the district would have to find $2 million in the event of two ballot failures.

“There’s a couple of options that we would have,” Hricay, said, listing reducing expenditures and using fund balances.

After adopting the budget and discussing the status of the election, the board made several staffing moves. They unanimously voted to hire Elizabeth Heilakka as a therapeutic support program teacher for the middle school, as well as accept a resignation and appointment of 11 new teacher mentors.

The budget overview, slideshow, and procedures for the upcoming election can be found here.

Nick Lieggi is a freshman at Oxford College of Emory University and was a member of the PMHS class of 2020. He began his journalism career at the Pelham...

Charles Stern • May 16, 2020 at 12:14 pm

Sup. Champ says, “This is probably not the worst of it..” Lieggi, ask her what is the worst of it, and what is the plan for that?