Residents question board during hearing on proposed $18.3 million budget for Pelham Manor

The Village of Pelham Manor Board of Trustees held a public hearing April 11 on the proposed $18.3 million budget for the year beginning June 1, with three residents asking questions on the spending plan.

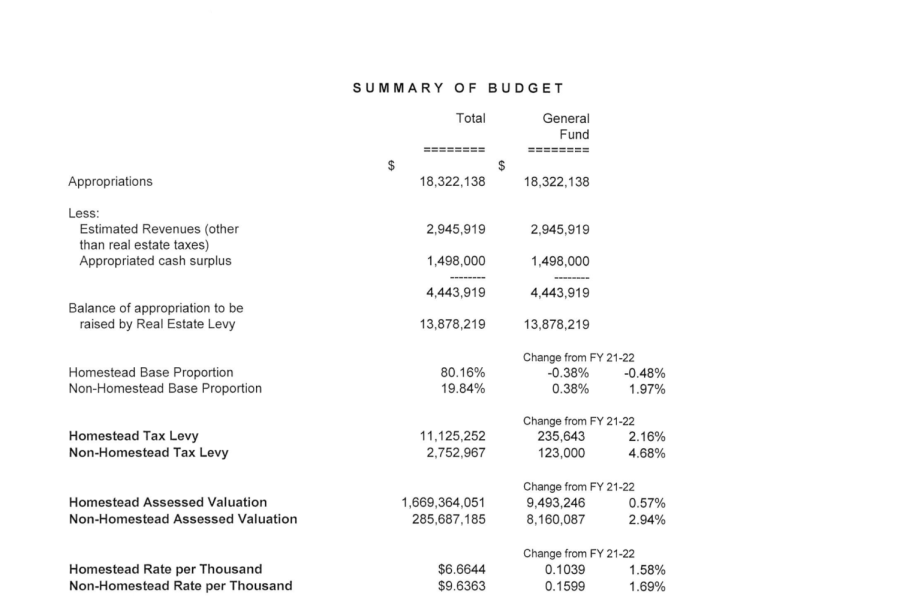

According to the tentative budget published on the village’s website, $13.8 million would be raised by the real estate tax levy. The remaining $5 million would come from non real-estate revenue, including $1.5 million appropriated from the surplus.

The homestead tax rate would rise by 1.58% to $6.66 per $1,000 valuation. The increase is below the New York State tax cap of 2%.

Resident Allison Frost asked about the use of the capital fund and the status of projects that had been mentioned in last year’s budget, including upgrades to the fire and police headquarters and renovations of the village hall exterior.

Village Manager John Pierpont, who is also the budget officer for Pelham Manor, said the “capital fund is allocated with moneys for doing capital projects like sewers and storm drains, purchase of capital equipment and making capital repairs.” He said that the village hall exterior renovations had already been completed and improvements to the headquarters were still in the design phase.

Ramsey McGrory, who ran in 2021 as the Democratic candidate for mayor, asked why taxes are going up if the village has surpluses.

“We don’t have surpluses that we just keep year after year,” said Trustee Maurice Owen-Michaane. “We don’t have capital-reserve funds like some other institutions in the town have. We have a fund balance, and we keep a certain percentage that the state says is a healthy amount.”

Pierpont said that spending all the money in the fund balance would not be a financially smart move by the village board.

The board also welcome Patrick Fannon to the Pelham Manor Police Department, gave administrative reports and voted to pay Fred Cook to clean the 368 catch basins in Pelham Manor to prevent stormwater runoff.

Ulysses Conrad was involved in a multitude of clubs and organizations after school such as Acapelicans, Military History, Speech and Debate, Science Research...

Ramsey McGrory • Apr 23, 2022 at 3:53 pm

This article does not fully describe the budget discussion, so please let me add some detail regarding my questions.

1. There is an aggregate surplus of over $5.0 million. The VoPM proposed to increase taxes on residents (‘homestead’) by 2.2% and businesses (‘non homestead’) by 4.7% percent. Given the business are shutting down, this is significant (the non homestead increase last year was over 4.0%). To be clear, assessments are not controlled by the VoPM (there’s a good piece of the PE on that) but the tax rate increases are 100% decided by the VoPM)

2. The village does not incur debt but has a surplus balance of over $5.0 million. This is materially higher than any state recommendation, and the village manager did not (and has not as of April 23) shared the capital budget that specifies capital expenditures. The mayor’s assertion of that the VoPM does not have surpluses is incorrect. There have been surpluses the last five years and the proposed budget also projects a surplus. (fwiw, the village significantly mis projects expenses consistently which produces the surplus).

3. I suggested that the VoPM could easily adjust the budget and *not* increase taxes by the ~$350k proposed. In the tax and financial climate we are in, it would be helpful and easily managed by the capable village manager.

4. Fire employees have been out of contract for 3 years. Police have been out of contract for almost a year. DPW is about a month away from being out of contract. Local govt’s primary responsibility (as reflected by $ spent) are these three important functions. We do not have any visibility into why we cannot find common ground to take care of our hard working teams, yet the fire and police chiefs received comp increases. I proposed that until the fire and police teams have contracts, the board does not increase the chiefs salaries.

I hope this helps explain my questions/comments during the budget discussion.