School district’s capital reserve ballot proposition makes no sense for taxpayers

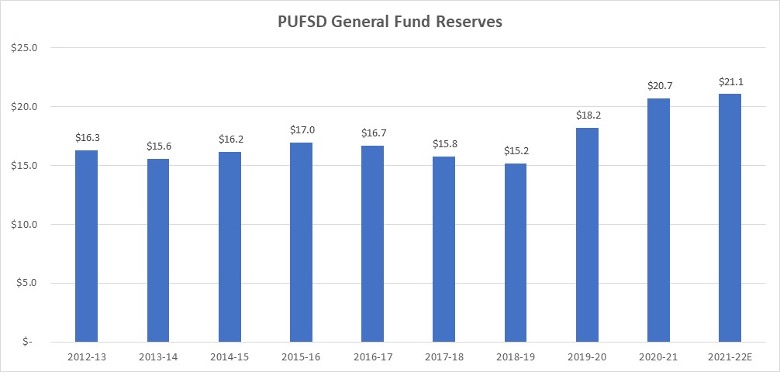

General fund reserves have climbed by about $5.6 million since 2018-19

May 14, 2022

As part of the board of education election and budget vote on May 17, the community is also being asked to vote on the creation of a capital reserve by the school district to fund future capital-expenditure needs. The school district currently holds approximately $21 million in general fund reserves, an amount that has grown substantially over the past two years, and the district has seemingly run out of places to park its excess cash and any future surpluses. Simply put, at a time when inflation is spiking, the funds in the district’s savings accounts are at their highest level in more than a decade. From a basic economic perspective, this makes no sense. Creating yet another savings account in the form of a new capital reserve seems to make even less sense. The acquisition of long-lived assets should be funded through a program of serial-bond issuance rather than a capital reserve while existing excess reserves and future surpluses should be applied toward educational programming, tax relief and debt service.

The district has proposed a tax-levy increase of 1.95% for the 2022-23 fiscal year. This will be the first year since 2017-18 the district has not levied the maximum amount (excluding the use of debt-service reserves) allowable under the state tax cap. Prior to 2018-19, the district had only taken the maximum levy once during the tax-cap era, and that was in 2014-15.

The onset of the Covid-19 pandemic in early 2020 resulted in significant cost savings for the district as a result of lower spending on items such as utilities, maintenance, field trips and substitute teachers. The district also benefited from additional federal and state aid and higher than expected sales tax receipts. As a result, the district generated a total surplus exceeding $5.5 million in the 2019-20 and 2020-21 fiscal years and is expected to generate another surplus in the 2021-22 fiscal year.

This unexpected benefit of the district’s cash balances has largely gone into various reserve accounts. The district’s general fund reserves have increased by approximately $5.6 million since 2018-19, from approximately $15.2 million to approximately $20.7 million as of June 30, 2021. Reserves are expected to increase again this fiscal year to $21.1 million, according to the Property Tax Report Card. Reserves would have been even higher if not for the $1.1 million purchase in 2019 of 314 Pelhamdale Ave., which is currently being used as office space by the district. The general fund reserves do not include an additional $2.1 million in the debt service reserve.

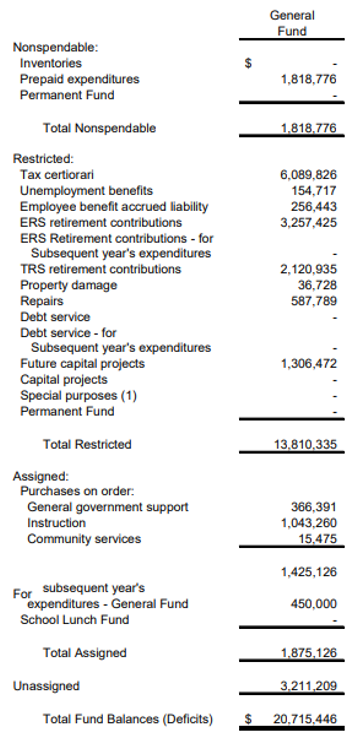

A breakdown of the district’s reserve balances as of June 30, 2021, taken from the district’s audited financial statements, is found below:

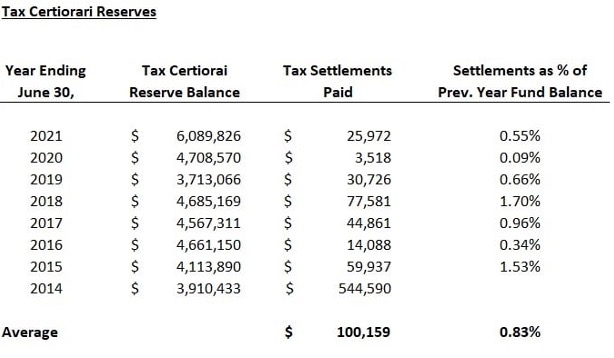

The largest component of the district’s general fund reserves is the tax certiorari reserve, which stood at $6.1 million as of June 30, 2021, up from $3.7 million in 2019, and is at the highest level it has been in many years. The tax certiorari reserve is used to pay property-tax settlements to commercial landlords who successfully challenge their assessments. (Homeowners who successfully challenge their assessments do not receive settlements, but rather see a decrease in future property taxes owed). Since 2014, only $800,000 total has been paid out by the district for tax settlements. As seen below, there has been an average of $100,000 in annual tax settlements since 2014, with a range of $3,518 to $77,581 between 2015-21.

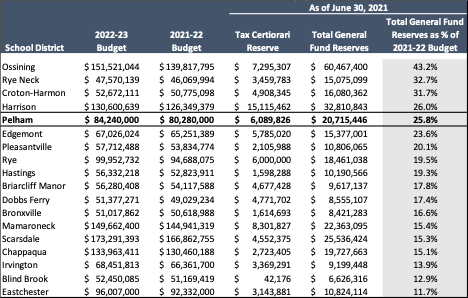

The tax certiorari reserve is one of the key reserves where money can be freely moved in and out during the year, which essentially circumvents the limitation on unassigned reserves, as evidenced by its effective use to purchase 314 Pelhamdale Ave. (further described below). This reserve is significantly overfunded given historical payout data and the lack of correlation to actual risk. Pelham’s tax certiorari reserve is one of the highest in Westchester (seen in the table below), which is notable given our relatively small commercial-tax base and the approximately $12 million of property tax revenues the district generates from commercial landlords. The Bronxville school district recently proposed reducing its tax certiorari reserve to $200,000 based on its historical tax-settlement data, with average settlements over the past five years of $14,000 and a high of $53,000. If Pelham sized its tax certiorari reserve similarly to Bronxville’s proposal (14.3 times the five-year average of $36,532 or 3.8 times the five-year high of $77,581), it would hold a reserve of between $292,759 and $521,880, freeing up more than $5.5 million in cash just from this one reserve that could be spent elsewhere.

The TRS retirement reserve, which was allowed to go into effect in April 2019 and is used to fund teacher pension fund contributions, has gone from zero in 2018 to $2.1 million in 2021 and is expected to increase further to $2.6 million in 2022, according to the Property Tax Report Card. The ERS retirement reserve, used for non-teacher pension fund contributions, has increased from $2.2 million in 2018 to $3.3 million in 2021.

The reserve for repairs and future capital projects has remained flat since 2016 at approximately $600,ooo, while a $1.3 million reserve to repair and replace the turf at Glover Field was funded in 2016 and is not expected to be spent for another three to five years from now, meaning it will have sat idle for a total of nine to twelve years instead of being applied to educational programming or tax relief.

Pelham’s reserve balances were 25.8% of its total budget in 2020-21 and are high on both an absolute and relative basis when compared to other school districts in Westchester.

The school district, on its 2022 capital reserve information page, states it “maintains a number of reserves, most of which can only be used for certain purposes.” While this statement is technically correct, in reality, funds from each reserve can easily be moved by the board of education to fund various needs. According to a summary of school board reserves by the New York State School Boards Association, reserves in many funds can be moved by a simple majority vote of the board of education or after a short period of time following a public hearing.

The district does in fact have a high level of flexibility in using its existing reserves for a wide variety of purposes through the use of transfers:

- A reading of the minutes of the school board’s last meeting of the fiscal year in June over the past few years shows a number of board authorizations to transfer funds among various reserves and the general fund.

- An audit of Pelham’s use of reserve funds completed by the Office of the New York State Comptroller in March 2016 lauded the district for appropriating funds from the retirement contribution reserves for use in the operating budget, stating, “We commend the board for approving a plan to use the excess funds transferred from the tax certiorari reserve to the retirement contribution reserve account to support the district’s operating budget over five years and thus reduce the district tax levy during this time or prevent an unusual increase in the district tax levy.”

- Per the minutes of the board of education’s June 25, 2019 meeting, the acquisition of 314 Pelhamdale Ave. was made possible by the transfer of $1.1 million from the general fund to the capital fund, from which payment was made to the sellers. A separate resolution authorized a subsequent transfer from the tax certiorari reserve to the general fund unassigned balance. This decrease in the tax certiorari balance in 2019, shown in the table above, is due to the transfer of funds from that reserve to effectively purchase 314 Pelhamdale Ave.

The acquisition of 314 Pelhamdale Ave. also demonstrates the level of flexibility the district has in its operating budget. The home required significant renovations in order to convert it into office space, and that expense was paid for out of the district’s operating budget. In addition, the district was unable to move all of its administrative staff to 314 Pelhamdale Ave. and subsequently entered into a lease agreement at the Sanborn Map Building, which was approved by the board of education on June 16, 2021, for a total of 5,598 square feet of additional office space with a full-year lease expense—also coming out of the operating budget—of approximately $163,500.

The acquisition of 314 Pelhamdale Ave. also demonstrates the level of flexibility the district has in its operating budget.

The district is now proposing to create a capital reserve on top of its $21 million in existing reserves. The district is seemingly running out of places to park taxpayer funds. The unassigned reserve, which can be spent on anything the district chooses, is limited to 4% of the budget and is currently at its maximum level. Annual contributions to the TRS retirement reserve are limited to 2% of total teacher compensation and the total TRS reserve size is limited to 10% of total teacher compensation, a level the district’s reserve is quickly approaching.

The proposal to create a capital reserve, whether intentional or not, is a signal to the community that the district will continue to generate surpluses over the next decade. If surpluses are indeed generated over the next few years, that money should be spent on education, taxpayer relief and toward our existing debt service, rather than going into a capital reserve.

The proposed capital reserve would be for a maximum of $10 million funded over 10 years at the discretion of the board of education. The establishment of a capital reserve requires the approval of the community through a vote and any spending from the capital reserve requires another vote; however, any funding of the capital reserve is at the sole discretion of the school board. Should the community vote to approve the creation of a capital reserve, the existing school board could choose to transfer millions of dollars from existing reserves into the capital reserve as soon as the day after the election.

The school district has argued that a capital reserve would allow it to fund its capital needs without the need for borrowing. In reality, the district would essentially be borrowing from taxpayers on an interest-free basis to pre-fund future capital-expenditure needs, which may not happen for years, rather than borrow funds for long-lived assets at the appropriate time.

- Borrowing allows for future taxpayers to share in the cost of capital improvements, rather than having existing taxpayers bear the entire burden.

- The district has the right to tax unlimited amounts to service its debt and has a AAA rating with a cost of capital of approximately 3% (based on the current market yield of the district’s existing debt). This is significantly lower than a Pelham taxpayer’s cost of capital, especially in an environment where inflation is nearing double digits. Taxpayers should be holding on to their own money and paying their bills rather than having the district hold funds in low-yielding accounts that will erode in value.

- The district has also argued a capital reserve provides greater transparency and control to taxpayers. However, the timeline and process of receiving taxpayer and state approvals for capital projects is nearly the same if the money is borrowed or funded out of a capital reserve—given a vote is needed in both scenarios. Even if a capital project is funded out of the operating budget or existing fund balances, there is an extremely robust public budget process that requires annual voter approval of the budget.

In 2018, during the Hutchinson Elementary School bond process, the district detailed a large number of capital projects required to maintain and improve its existing infrastructure, including replacing boilers, upgrading electrical equipment and installing new HVAC systems. The district estimates the current cost of these projects to be approximately $15 million, which would be offset by some aid from New York State.

The district should immediately begin a program of borrowing every five to ten years to ensure its infrastructure is consistently up to date.

The district should immediately begin a program of borrowing every five to ten years to ensure its infrastructure is consistently up to date. Serial-bond issuance would be tax-neutral to the community as new bonds would be issued when old bonds mature. Borrowing sporadically and only in times of emergency, as experienced in 2018 when a new Hutchinson School was needed, results in ebbs and flows in property taxes.

Small bond issuances are relatively common in financing municipal and school district projects:

- The Pelham school district issued $3 million of bonds in 2017 for locker-room renovations and the upgrading of electrical panels at Pelham Memorial High School.

- The Village of Pelham approved the issuance of $2.36 million in debt to purchase four garbage trucks.

- The Croton-Harmon school district is seeking approval next week to issue $447,800 in bonds to purchase two buses.

The old saying goes that a dollar today is worth more than a dollar tomorrow. Paying for our capital needs over time, rather than paying upfront, is more cost effective for the community given the district’s low cost of capital and the current inflationary environment. The district has the ability to pay back its debt with “cheap dollars” over a ten-year timeframe or longer while providing a great deal of flexibility to taxpayers.

The school district has stated that borrowing for capital projects would result in an increase in taxes for the community. However, the district can apply its existing excess reserves and surpluses toward immediate tax relief by appropriating funds toward upcoming budgets and lowering the tax levy. This immediate savings for taxpayers would then be offset by a slight increase in taxes spread out over time associated with debt service. Taxpayers who may move out of Pelham would never see a benefit from dollars that were put aside in a reserve.

In addition, the school district is expected to receive PILOT (payment in lieu of taxes) payments from the proposed Pelham House apartment project in the Village of Pelham, in addition to taxes from the proposed development at 139 Fifth Ave. These payments, which are applied to the district’s total allowable tax levy, will result in savings for individual taxpayers in Pelham, making any slight increase in school taxes to service debt more palatable.

Taxpayers who may move out of Pelham would never see a benefit from dollars that were put aside in a reserve.

Also, ask yourself, what happens if the district is unable to generate the surpluses necessary to fund the capital reserve and pay for projects? It would either need to delay these projects or borrow before costs continue to rise and existing equipment fails. Beginning a borrowing program sooner rather than later eliminates this risk.

It is important to note that the community is being asked to vote on the creation of a capital reserve as a separate proposition from the budget. Voters have the ability to approve the budget while voting against the capital reserve. It makes more financial and practical sense to fund our capital needs through a borrowing program and to apply the district’s excess funds toward educational programming, tax relief and debt service rather than adding to already-inflated reserves.

Carrie Liaskos • May 14, 2022 at 12:57 pm

Thank you for doing the math and for sharing your thoughtful analysis. Our dollars are our dollars and the District should not be over-reaching when they are sitting on millions in reserves. In fact, those reserves should be used to lower our taxes.

Arthur Long • May 14, 2022 at 8:53 am

This is an excellent analysis and the economics are indisputable.

Laurie Flynn O'Malley • May 12, 2022 at 8:33 pm

Who is the author? A student? An interested community member providing information? A partisan politician with an agenda? It would certainly help to know as that information isn’t provided in the byline.

bob parisi • May 13, 2022 at 10:25 am

Mr. Shekane is a concerned citizen.

Jonathan Bernstein • May 13, 2022 at 7:12 pm

A taxpayer. And one who apparently has a pretty good handle on the numbers.

Emily Pauley • May 13, 2022 at 7:46 pm

A Pelham resident.

Emily Pauley • May 12, 2022 at 8:10 pm

Thank you so much. We should all vote No to the new reserve fund.