Bulletin from Office of Pelham Town Assessor on reporting STAR credit on income taxes

Editor’s note: This notice was provided by Town of Pelham Assessor Joe Battaglia. The Pelham Examiner publishes notices in the form received as a service to the community.

Question: Are STAR credit recipients required to report the STAR credit on their income taxes?

Answer: Most taxpayers take the standard deduction, and are not required to report the STAR credit on their income taxes. Those who itemize their deductions should reduce their itemized deduction for real estate taxes paid by the amount of the STAR credit received during the tax year.

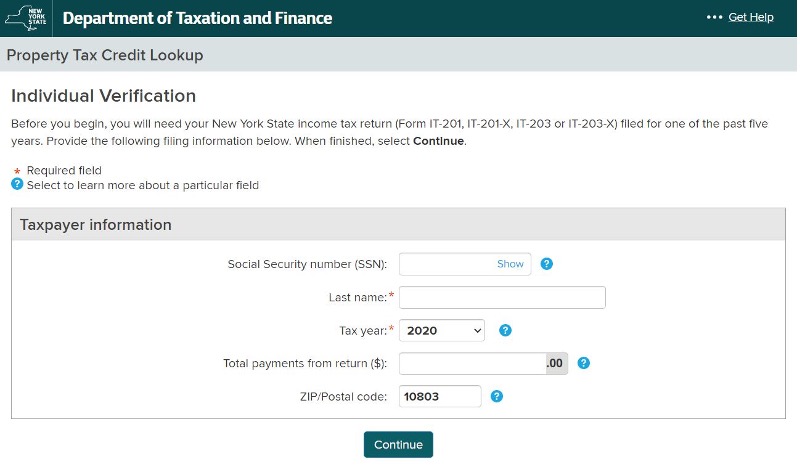

When you receive a check for the STAR credit, you should always keep the check stub with your tax records. If you haven’t done so, you can use the NYS Department of Taxation and Finance Property Tax Credit Lookup to verify if you received a check. Before you begin, you will need:

- your New York State income tax return (Form IT-201, IT-201-X, IT-203 or IT-203-X) filed for one of the past five years.

- the Total payments amount from the return you use for verification:

- Form IT-201, line 76

- Form IT-201-X, line 77

- Form IT-203, line 66

- Form IT-203-X, line 67

The following is a screenshot of the Property Tax Credit Lookup Screen, for reference:

Have additional questions about STAR? The Homeowners’ STAR hotline is 518-457-2036