From town assessor: State sending letter on new homeowner tax-rebate credit to determine eligibility

Editor’s note: This notice was provided by Town of Pelham Assessor Joe Battaglia. The Pelham Examiner publishes notices in the form received as a service to the community.

If you have not yet received the new Property Tax Relief Credit then be on the lookout for a letter from the NYS Department of Taxation (NYSDTF), as they have just notified our office that they will begin mailing a new letter (RP-5303) to homeowners from whom they need additional information in order to determine their eligibility for the homeowner tax rebate credit.

The letter asks the homeowners to register for the credit using the NYSDTF’s new HTRC registration online application.

Only homeowners who receive the letter need to register for the HTRC. Other homeowners will not be able to access the application.

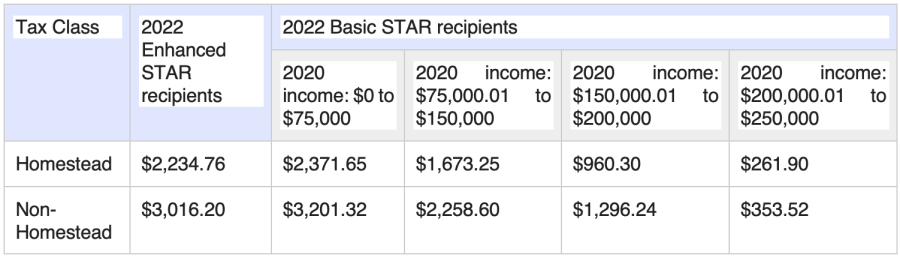

Below are the Homeowner Tax Rebate Credit (HTRC) amounts for the Town of Pelham, as originally outlined by the NYSDTF earlier this year.

Note: The amount of your credit could be less than the amount shown below if your net school tax liability is less than the credit amount after taking into account your STAR benefit. For details, see HTRC: Limitations.

Have additional questions about STAR? The Homeowners’ STAR hotline is 518-457-2036.